Advice to Boost Your Experience With Dollar Purchase Market Opportunities

Guiding dollar buy-sell possibilities needs a calculated approach. Recognizing market patterns is necessary, as changes can considerably affect currency worths. Timing transactions carefully can bring about much better outcomes. Furthermore, using different money exchange platforms can enhance effectiveness. It's essential to evaluate threat variables and set sensible goals. By taking into consideration these components, traders can boost their outcomes and experiences. What other approaches might even more fine-tune their strategy?

Comprehending Market Trends

Understanding market patterns is necessary for making notified choices in currency trading. Traders examine numerous indications, such as economic information, geopolitical occasions, and market belief, to assess the direction of money motions. Identifying bullish or bearish patterns allows investors to take advantage of prospective possibilities, optimizing profits while lessening dangers.

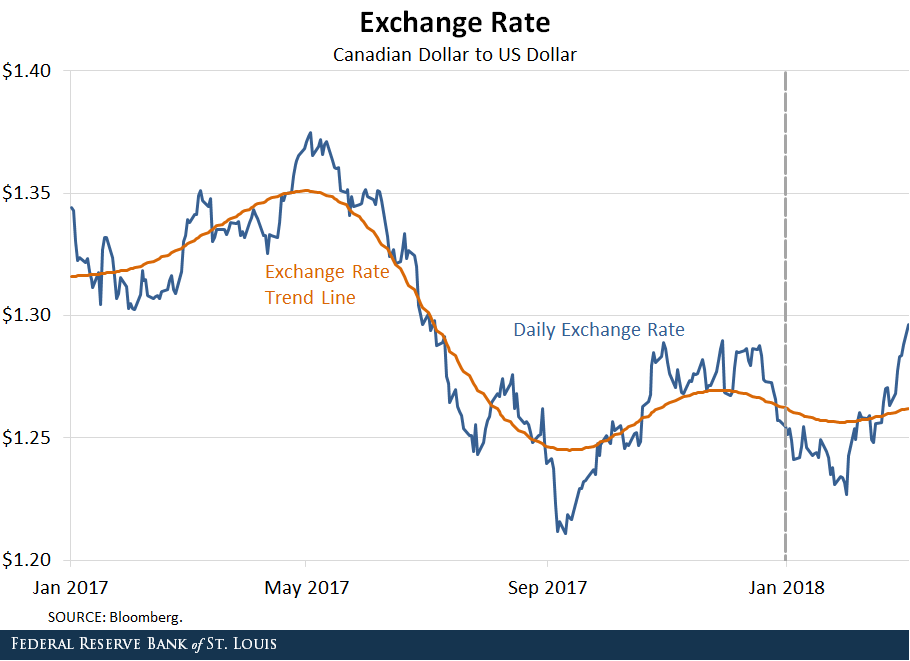

Technical analysis plays a considerable role in understanding these trends, including the research of rate graphes and historic data to predict future movements. Traders frequently utilize tools like relocating standards and trend lines to recognize patterns. Additionally, remaining notified regarding international economic conditions, such as rate of interest modifications and inflation rates, can give useful insights into money variations.

Timing Your Transactions

How can traders efficiently time their transactions to make best use of earnings? Timing is important in the dollar buy-sell market, as changes can substantially influence returns. Traders must carefully check economic indicators such as interest prices, inflation, and work information, as these typically dictate currency activities. Furthermore, understanding market view can give understandings into possible cost changes, allowing investors to position themselves advantageously.

Using technical evaluation can likewise aid in timing choices. Traders may try to find signals or patterns, such as relocating averages or assistance and resistance levels, to recognize optimal entrance and exit factors. Establishing notifies for vital cost degrees can guarantee that traders stay informed regarding market changes without continuous monitoring.

Being aware of geopolitical occasions, such as elections or trade contracts, is vital, as these can lead to unexpected changes in currency values. Inevitably, a critical strategy to timing can enhance profit margins in buck buy-sell opportunities.

Utilizing Money Exchange Operatings Systems

When involving in currency exchange, picking reputable systems is essential for successful transactions - Dollar Buy Sell. Comprehending exchange rates is similarly essential, as they straight affect the worth received during deal opportunities. Together, these components can substantially influence overall trading results in the dollar market

Picking Trustworthy Platforms

Comprehending Exchange Fees

Recognizing currency exchange rate is fundamental for investors making use of money exchange platforms. These prices dictate just how much one money is worth in regard to another, directly affecting trading decisions. For effective trading, people must keep track of fluctuations affected by financial signs, geopolitical events, and market view. Money exchange platforms often give real-time information, allowing investors to make educated options. Additionally, recognizing the bid-ask spread is important, as it represents the expense of entering and leaving professions. Traders need to additionally acquaint themselves with various money pairs and their historic performance, as this knowledge can enhance calculated preparation. By realizing these principles, traders improve their chances of maximizing dollar buy-sell possibilities, ultimately maximizing their revenues.

Setting Sensible Goals

Exactly how can investors set realistic objectives in the unstable globe of money exchange? Developing possible targets is important to traversing this unpredictable market. Traders must start by assessing their experience degree, understanding that newbies might require to intend for smaller, more convenient earnings. It is a good idea to Related Site set particular, quantifiable, possible, pertinent, and time-bound (WISE) objectives that align with private trading techniques.

Next off, investors should consider their threat tolerance and readily available funding. This enables for establishing goals that are both enthusiastic and based in individual monetary conditions. Frequently evaluating and adjusting these objectives in reaction to market conditions can foster a proactive technique, assisting traders remain versatile. Additionally, maintaining a trading journal can aid in monitoring progress and refining future goals. By setting practical objectives, traders can maintain inspiration and focus while going across the intricacies of dollar buy-sell chances.

Assessing Threat Aspects

Liquidity levels can influence the implementation of professions, triggering slippage during high volatility periods. Traders need to also understand leverage effects, as it can enhance both earnings and losses. Conducting thorough analysis and carrying out threat management methods enables traders to browse the complexities of dollar buy-sell chances efficiently, cultivating an extra informed trading experience. Understanding these threat factors is crucial for making sound investment choices in the dynamic foreign exchange market

Staying up to date with Economic Indicators

Comprehending key economic indications is crucial for any individual aiming to make educated choices in buck trading. By evaluating market patterns and being mindful of worldwide financial occasions, investors can better expect fluctuations in money worth. Remaining upgraded on these aspects can significantly enhance one's ability to determine deal opportunities.

Trick Economic Indicators

As market dynamics constantly change, remaining notified regarding key financial indications becomes vital for any person entailed in currency trading. These signs act as essential devices for examining the general economic health and wellness of a nation and can significantly affect money worths. Trick signs include Gross Domestic Item (GDP), joblessness rates, inflation steps such as the Customer Cost Index (CPI), and rates of interest established by central financial institutions. Modifications in these metrics can lead to changes in currency stamina, affecting buy and offer choices. Additionally, profession balances and manufacturing data likewise offer understandings right into economic efficiency. By monitoring these signs, investors can make even more enlightened choices, boosting their strategies in the competitive landscape of buck get and offer possibilities.

Market Patterns Evaluation

To properly browse the intricacies of currency trading, traders need to analyze market fads while continuing to be in harmony with economic indications. Recognizing the relationship between trends and economic data is vital for making educated choices. Investors need to keep track of essential indicators such as GDP development, rising cost of living prices, and work figures, as these can signify shifts in currency value. By observing historical patterns and existing market motions, investors can identify potential entry and leave factors. Using technological analysis devices can additionally enhance their insights, highlighting price degrees and fads. In addition, staying updated check out here on central bank policies and geopolitical advancements can offer context for market fluctuations. In final thought, a detailed approach to market patterns click here for more analysis is essential for successful trading in dollar buy-sell chances.

Worldwide Economic Events

International economic occasions considerably influence currency markets, making it critical for investors to stay informed regarding significant economic indicators. Trick indications include GDP growth prices, joblessness figures, rising cost of living data, and consumer self-confidence indexes. These metrics provide insights into financial health and wellness and can trigger changes in currency worths. An increase in GDP usually signals a strong economy, potentially strengthening the dollar. Additionally, main bank plans, affected by these signs, play a necessary function in currency valuation. Traders ought to keep an eye on scheduled statements and records for possible market impacts. By staying updated on these economic signs, investors can make informed choices, boosting their methods in dollar get market opportunities and steering the unstable money landscape efficiently.

Regularly Asked Inquiries

What Prevail Risks to Stay Clear Of When Acquiring Bucks?

Common challenges to prevent when purchasing dollars consist of not looking into present currency exchange rate, failing to contrast multiple resources, neglecting hidden charges, and impulsively purchasing without taking into consideration market patterns or personal monetary objectives.

Exactly How Do Geopolitical Events Impact Buck Purchases?

Geopolitical occasions greatly influence buck purchases by changing market security, impacting financier self-confidence, and creating changes in currency exchange rate. Unrest or plan adjustments can cause raised need or supply imbalances in buck money.

Can I Set Alerts for Dollar Cost Changes?

Yes, individuals can set notifies for buck cost changes with different monetary systems and apps. These informs inform individuals of substantial changes, making it possible for prompt choices in trading or deals based upon market motions.

What Resources Can Help Me Track Buck Trends Better?

Various economic information internet sites, mobile apps, and brokerage firm systems provide real-time charts, market evaluation, and specialist discourse. Financial indications and currency exchange records likewise supply valuable understandings for tracking buck fads successfully.

Are There Tax Ramifications for Money Trading Profits?

Yes, currency trading profits typically have tax ramifications (Dollar Buy Sell). Investors may need to report gains as capital gains or regular earnings, depending on their conditions, requiring careful record-keeping and consultation with tax specialists for conformity